What is an Absentee Owner in Real Estate Investing?

Absentee ownership opens up many possibilities for real estate investors who want to build wealth without being tied to a specific location.

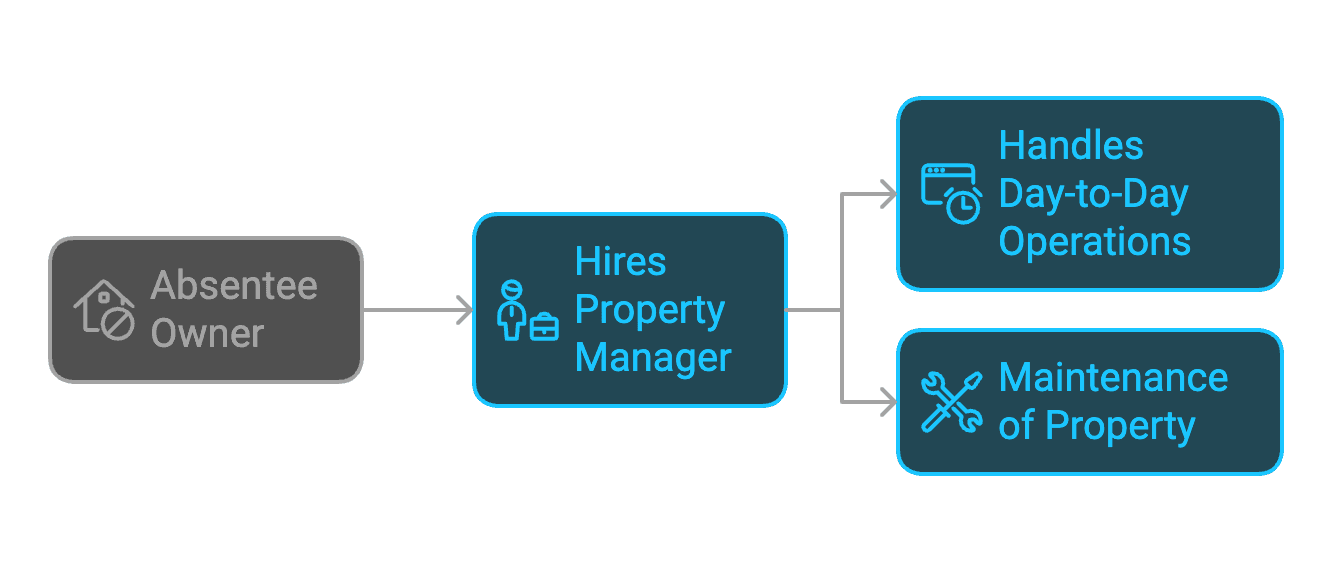

Absentee Owner: An absentee owner is someone who owns a property but does not live there. This type of owner typically lives elsewhere and often hires a property manager to handle the day-to-day operations and maintenance of the property.

Types of Absentee Owners

The real estate market includes several different types of absentee owners.

Investment property owners make up a large segment, buying properties purely for income generation.

Vacation home owners maintain secondary residences in desirable locations. Some become absentee owners through inheritance, receiving properties from family members.

Corporate property owners often maintain portfolios of rental properties across multiple locations.

International investors purchase U.S. properties while residing in other countries.

Benefits of Absentee Ownership

Owning property without living in it creates unique advantages. You can spread your investments across different markets, reducing risk through diversification. Rental properties generate monthly income without requiring your physical presence. The tax code offers numerous benefits for investment property owners, including deductions for expenses and depreciation. You're free to live wherever you choose while maintaining your real estate portfolio. Many investors start with one property and gradually expand their holdings across multiple locations.

Challenges and Considerations

Managing property from afar presents certain challenges. Finding trustworthy property managers requires careful screening and clear communication. Professional management services cost money, typically 8-12% of monthly rent. Distance can complicate maintenance issues and tenant relationships. Each location has its own rules and regulations that require compliance. Insurance needs might differ for non-owner-occupied properties.

Success as an absentee owner requires solid systems. Regular property inspections catch problems early. Create detailed budgets that account for all expenses, including maintenance reserves. Establish clear procedures for handling emergencies. Modern property management software helps track everything from rent collection to maintenance requests.

Many people think absentee ownership means completely hands-off management - that's not always true. Returns vary based on market conditions and management quality. The time commitment depends on your systems and team. While there are risks, proper planning minimizes most issues.

Legal and Financial Aspects

The IRS treats investment properties differently from primary residences. Insurance companies require specific coverage for non-owner-occupied properties. Cities and states have varying landlord-tenant laws. Property owners must understand their rights and responsibilities under local regulations.

Should You Become an Absentee Owner?

Consider your current situation. Do you have capital ready to invest? Can you handle occasional challenges without stress? Think about your five-year and ten-year goals. Does absentee ownership align with your vision?

Bellhaven Real Estate specializes in helping investors navigate property ownership. Our team provides comprehensive support, from finding properties to ongoing management. We'd love to discuss your investment goals and show you how absentee ownership might fit into your strategy.