What is an Interest Rate Ceiling on an Adjustable Mortgage?

I've noticed many homeowners get nervous when discussing adjustable-rate mortgages. The fear of skyrocketing interest rates keeps them up at night. But there's a built-in safety net that many people don't know about - the interest rate ceiling.

Think of it as a protective umbrella for your mortgage. While market rates might pour down, your rate can only rise so high before hitting this ceiling. This protection gives you the flexibility of an adjustable-rate mortgage without the worry of astronomical payment increases.

Interest Rate Ceiling: The highest interest rate that can be charged on an adjustable-rate mortgage (ARM) over its entire term, regardless of market conditions. This cap protects borrowers from extreme rate increases while still allowing for normal market adjustments.

Understanding Interest Rate Ceilings

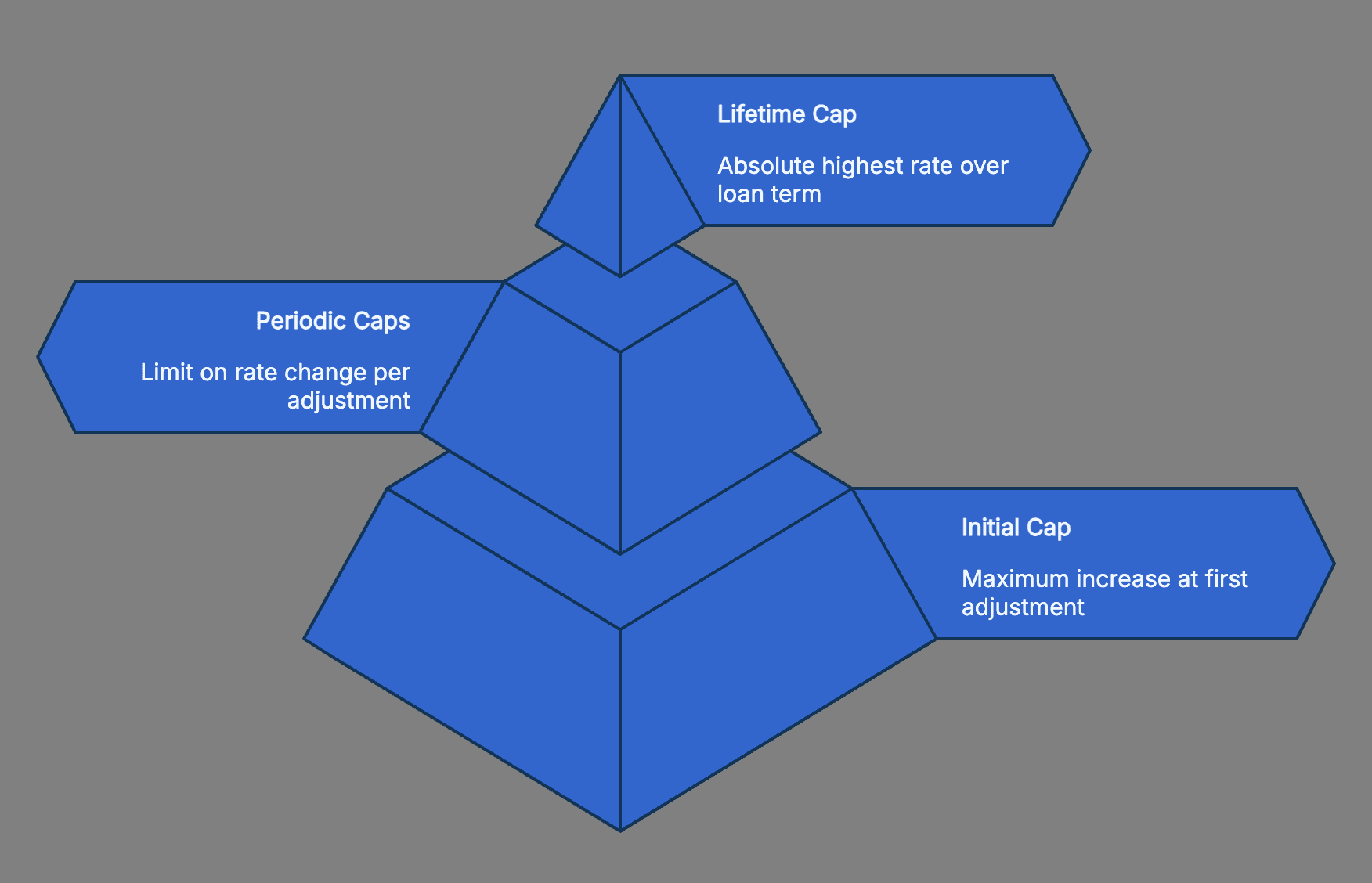

Interest rate ceilings aren't just simple caps - they're actually made up of several components working together. The main pieces include the lifetime cap (the absolute highest your rate can go), periodic adjustment caps (how much your rate can change each time it adjusts), and the initial adjustment cap (the maximum increase allowed at your first rate change).

These caps work like guardrails on your mortgage journey. If market rates spike dramatically, your loan's interest rate will rise more gradually and stop at a predetermined maximum. For example, if you start with a 4% rate and have a 5% lifetime cap, your rate will never exceed 9%, no matter what happens in the market.

Benefits of Interest Rate Ceilings

The most obvious benefit is protection from market chaos. But there's more to it than that. With a ceiling in place, you can actually plan your future budget with confidence. You'll know the absolute maximum your payment could reach, making it easier to decide if an ARM fits your financial situation.

I find that many borrowers sleep better at night knowing there's a limit to how high their rate can go. It's like having insurance against extreme market conditions while still benefiting from potentially lower rates than a fixed-rate mortgage.

Types of ARM Caps

Let's break down the different types of caps you'll encounter:

Initial adjustment cap: Limits how much your rate can increase at the first adjustment

Subsequent adjustment cap: Controls rate increases for each period after the first adjustment

Lifetime cap: Sets the maximum rate increase over the entire loan term

Common cap structures are often written as three numbers, like "2/2/5" or "5/2/5". These numbers represent the initial, subsequent, and lifetime caps as percentages. A 2/2/5 structure means your first adjustment is capped at 2%, subsequent adjustments at 2%, and the lifetime cap is 5% above your starting rate.

Real-World Applications

Let's say you have a $300,000 ARM with a 2/2/5 cap structure, starting at 4%. Your maximum rates would be:

First adjustment: 6% (4% + 2%)

Each subsequent adjustment: Up to 2% higher than previous rate

Lifetime maximum: 9% (4% + 5%)

This structure helps you understand exactly how high your payments could go, making it easier to compare with fixed-rate options.

Common Misconceptions

People often think rate ceilings prevent all significant payment increases - they don't. They simply limit how fast and how high rates can climb. Each ARM has its own cap structure, so you can't assume they're all the same.

Another myth is that caps make ARMs as safe as fixed-rate mortgages. While caps provide protection, ARMs still carry more rate risk than fixed-rate loans.

Related Concepts

Rate ceilings work alongside other ARM features:

Interest rate floors: The lowest your rate can go

ARM indexes: The market indicator your rate is based on

Margin rates: The amount added to the index to determine your rate

Payment caps: Limits on payment increases (separate from rate caps)

Making Smart Decisions

ARMs with rate caps might be right for you if you plan to sell or refinance before the first adjustment, or if you can handle some payment variation but want protection from extreme increases. Look carefully at different cap structures - they can significantly impact your maximum possible payment.

Interest rate ceilings provide valuable protection for ARM borrowers, making these loans more predictable and manageable. While they don't eliminate all risk, they do create clear boundaries for rate increases.

Ready to explore your mortgage options? At Bellhaven Real Estate, our experts can help you understand the ins and outs of ARM rate caps and find the perfect loan structure for your needs. Contact us today for a personalized consultation!