What is Involuntary Alienation in Real Estate Law?

Losing your property without choosing to sell it might sound like a nightmare, but it's a real possibility through a process called involuntary alienation. Many property owners don't realize their ownership rights can be challenged or terminated under certain circumstances. Let's explore what this means for you and your property rights.

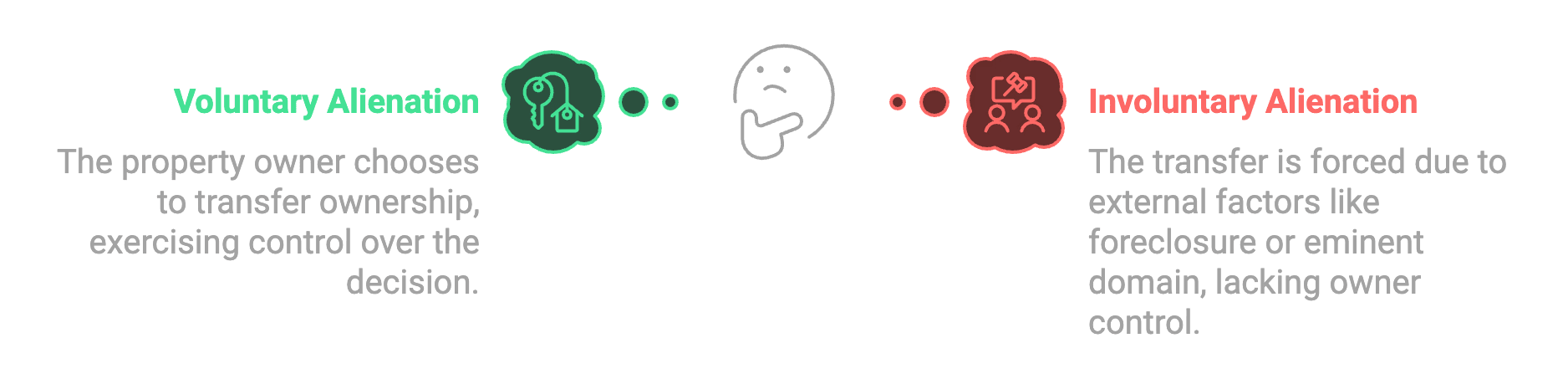

Involuntary Alienation: The transfer of property ownership that occurs without the owner's consent or direct action, such as through foreclosure, bankruptcy, or eminent domain proceedings. This type of transfer can also happen through court orders, tax sales, or adverse possession claims.

Common Types of Involuntary Alienation

Foreclosure

Missing mortgage payments can trigger foreclosure proceedings. Banks follow strict protocols, starting with formal notices and ending with property seizure. You'll typically receive multiple warnings and opportunities to catch up on payments before losing your home. The timeline varies by state, but most foreclosures take several months to complete.

Eminent Domain

The government can take private property for public use - think new highways or schools. While you can't stop eminent domain, you must receive fair market value for your property. The process includes formal notifications, property appraisals, and negotiation opportunities.

Tax Sales

If you fall behind on property taxes, local governments might sell your property to recover the debt. They'll place a tax lien on the property first, followed by a tax sale if the taxes remain unpaid. Most states offer redemption periods where you can reclaim your property by paying all past-due taxes plus interest.

Bankruptcy Proceedings

Filing for bankruptcy might force property transfers to satisfy debts. Chapter 7 bankruptcy could require selling non-exempt properties, while Chapter 13 might let you keep your property through a structured repayment plan.

Legal Framework and Property Rights

The Fifth Amendment protects property owners from unfair government takings, requiring just compensation for eminent domain. State laws add extra layers of protection, setting specific rules for foreclosures, tax sales, and property transfers.

Prevention and Protection Strategies

Set up automatic payments for mortgages and property taxes

Keep detailed records of all property-related documents

Monitor your property tax assessments

Maintain clear property boundaries

Common Misconceptions

Many people believe they can't lose their property if they have a clear title. That's incorrect. Even with perfect ownership documentation, involuntary alienation can occur through legal channels. The government's power of eminent domain exists regardless of how long you've owned the property.

The Impact on Property Value

Properties involved in involuntary alienation often sell below market value. Foreclosed homes might sell at auction for less than their worth, affecting neighboring property values. Recovery of property values takes time and depends on local market conditions.

Involuntary vs Voluntary Alienation

Voluntary alienation - where you choose to sell or transfer property - contrasts sharply with involuntary processes. Title insurance protects against certain types of involuntary property loss, making it a critical purchase for property owners.

Legal Assistance and Resources

If you're facing involuntary alienation, consult a real estate attorney immediately. Many states offer housing counseling services and legal aid for property owners facing foreclosure or eminent domain proceedings.

Protecting Your Property Rights

Understanding involuntary alienation helps you protect your property rights. Stay informed about your obligations as a property owner, maintain good financial standing, and keep detailed records of all property-related transactions.

Bellhaven Real Estate's team of professionals can guide you through property transactions and help you understand your rights as a property owner. We're here to help you make informed decisions about your real estate investments.