What is an Involuntary Lien on Property and How Does it Work?

I've noticed many property owners panic when they discover an involuntary lien on their property. That's completely normal - nobody wants to find out there's a legal claim against their property, especially one they didn't agree to. Let me walk you through everything you need to know about involuntary liens, from what they are to how to handle them.

Involuntary Lien: A legal claim placed against a property without the owner's permission or agreement. Common examples include property tax liens, income tax liens, and special assessment liens that are automatically created by law when certain obligations remain unpaid.

Understanding Involuntary Liens in Real Estate

Unlike voluntary liens (like mortgages) that you choose to take on, involuntary liens pop up without your consent. Think of them as legal IOUs attached to your property. These liens give creditors a claim to your property until you settle the debt. What makes them different from voluntary liens? You don't sign up for them - they're imposed on you through legal processes or statutory requirements.

Common Types of Involuntary Liens

Let's break down the main types of involuntary liens you might encounter:

Tax Liens

Property Tax Liens: Created when you fall behind on local property taxes

Federal Tax Liens: IRS claims against property for unpaid federal taxes

State Tax Liens: Similar to federal liens but at the state level

Judgment Liens

These arise from court decisions. If someone sues you and wins, they might place a judgment lien on your property to secure payment.

Mechanic's Liens

Contractors or material suppliers can file these if they don't receive payment for work or materials provided for your property improvements.

HOA Assessment Liens

Your homeowners association can place liens for unpaid dues or special assessments.

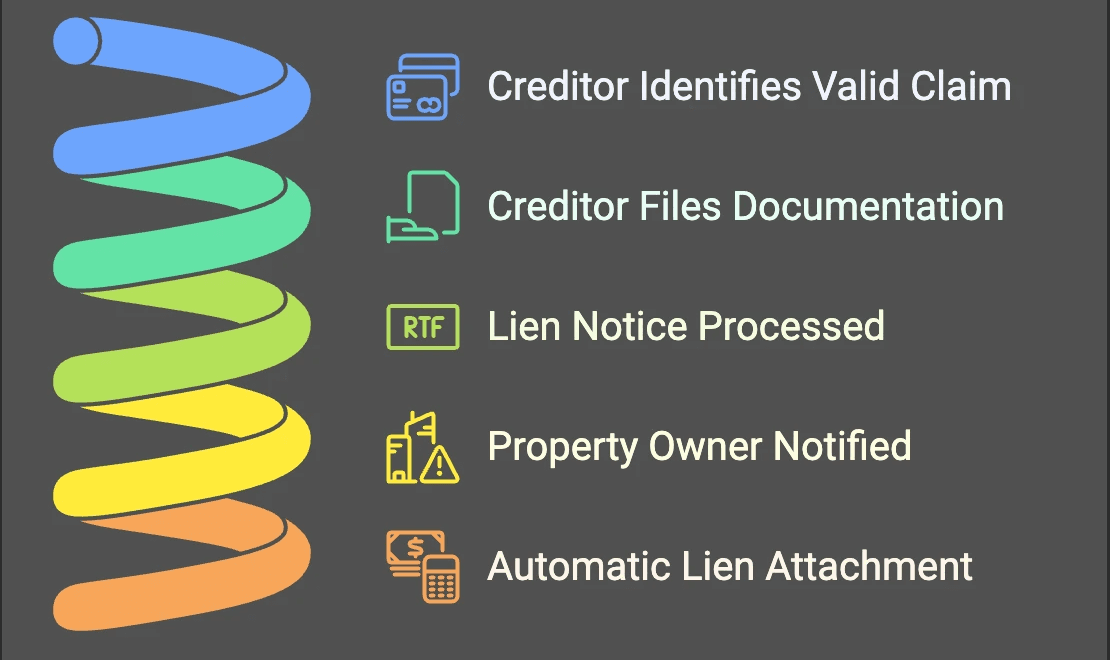

How Involuntary Liens Are Created

The creation of involuntary liens follows strict legal procedures. First, the creditor must have a valid claim backed by evidence of the debt or obligation. Then, they must file proper documentation with the county recorder's office, including the lien notice and any supporting court judgments. You'll typically receive formal notice of the lien filing, though some liens (like tax liens) can be automatically attached without advance notice due to special statutory powers.

The recording date of the lien is crucial as it establishes priority - determining which creditors get paid first if the property is sold or foreclosed. While earlier recorded liens typically take precedence over later ones, certain liens like property taxes may have automatic priority regardless of recording date. This priority system becomes especially important when multiple creditors have claims against the same property.

Resolving Involuntary Liens

I've found these strategies work best for dealing with involuntary liens:

Pay the debt in full if possible

Set up a payment plan with the lienholder

Negotiate a settlement for less than the full amount

Challenge invalid liens through legal channels

Prevention Strategies

The best approach? Stop liens before they happen:

Keep up with property tax payments

Get everything in writing when hiring contractors

Check your property's title regularly

Stay current on all financial obligations

Common Misconceptions & Legal Rights

Let me clear up some confusion about involuntary liens. They don't disappear if you ignore them - they usually just get worse. Not all liens are created equal - some have priority over others. And while you might not have created the lien, you're responsible for resolving it.

You have rights! Lienholders must follow legal procedures, provide proper notice, and respect time limits for filing. If someone places an invalid lien, you can challenge it through the courts.

Professional Help and Resources

Don't tackle involuntary liens alone. Work with:

Real estate attorneys who specialize in lien resolution

Title companies that can search for and explain liens

Tax professionals for tax lien guidance

Real estate agents who understand lien impacts on property sales

Involuntary liens are serious business, but they're not the end of the world. At Bellhaven Real Estate, we help property owners navigate these challenges every day. Our team can evaluate your situation, connect you with the right professionals, and guide you through the resolution process.