What is a Lien Theory State in Real Estate Lending?

Real estate lending involves different approaches to property rights and ownership across states. If you're buying property, the way your state handles mortgages directly affects your rights as a property owner. Let me break down what a lien theory state is and why it matters to you.

Lien Theory State: A lien theory state is one where the borrower keeps legal ownership of the property when taking out a mortgage, while the lender holds a lien against the property as security for the loan. In these states, the lender can only take possession of the property through formal foreclosure proceedings if the borrower defaults on the loan.

Use this simple tool to check if your state is Lien Theory:

How Lien Theory States Work

The structure of property ownership in lien theory states puts you, the borrower, in a stronger position. You maintain legal title to your property while the lender places a lien against it. Think of it like putting up collateral - you still own your property, but the lender has a legal claim to it if you stop making payments.

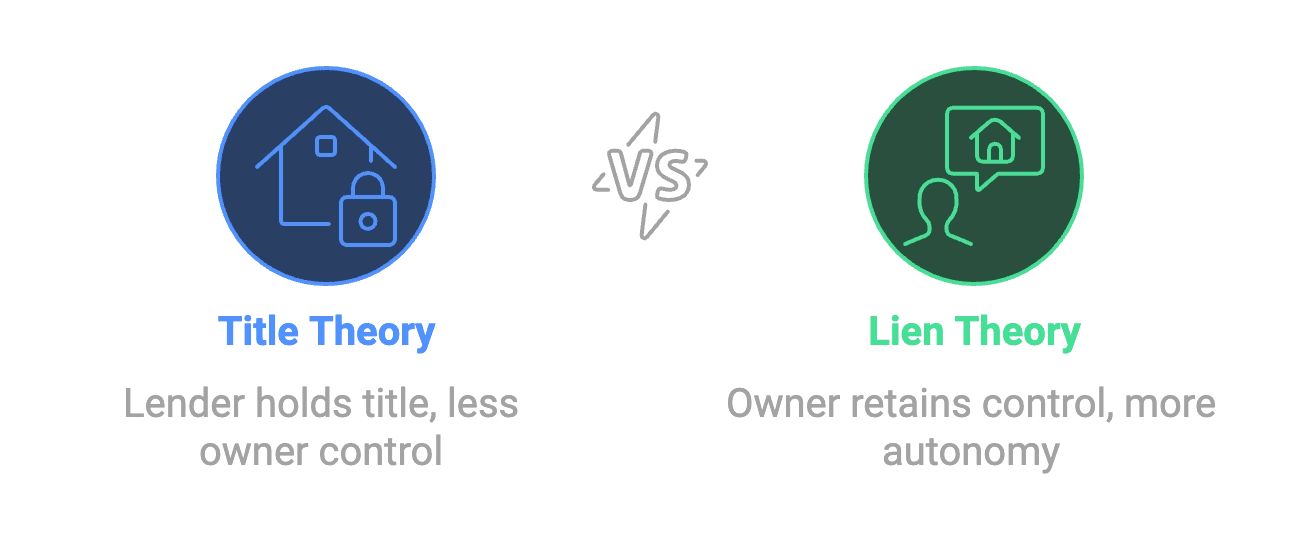

This differs from title theory states, where the lender holds the actual title until you pay off the loan. Most states follow lien theory, which gives property owners more control over their real estate.

The Foreclosure Process in Lien Theory States

If you miss mortgage payments in a lien theory state, the foreclosure process follows strict legal guidelines. The lender must file a lawsuit and go through the courts to take possession of your property. This judicial foreclosure process includes:

Written notice of default

Time to cure the default

Court proceedings

Public notice requirements

Sale of the property

This process often takes several months, giving you time to catch up on payments or make other arrangements.

Benefits and Implications

As a property owner in a lien theory state, you have significant advantages:

Full control over property use and improvements

Ability to sell or transfer the property (subject to the lien)

Right to any rental income or profits

Protection through formal foreclosure requirements

Lenders still maintain security through their lien rights, but must follow strict legal procedures to enforce them.

Common Misconceptions

Many people misunderstand their rights in lien theory states. You don't need the lender's permission to:

Make property improvements

Rent out the property

Sell the property (though you'll need to pay off the loan)

The lender's only right is to foreclose if you default on the loan.

Practical Applications

During the home buying process, you'll sign a mortgage agreement that creates the lender's lien. The property deed stays in your name, recorded at the county office. This makes refinancing and property transfers simpler since you already hold the title.

State-Specific Considerations

Most U.S. states use lien theory, but laws vary by state. Some states mix elements of both lien and title theory. Your state's specific laws affect:

Foreclosure timelines

Borrower rights

Required legal procedures

Recording requirements

Relationship to Other Real Estate Concepts

Lien theory connects with several other real estate practices:

Title insurance protects your ownership rights

Property recording systems track liens and ownership

Mortgage agreements define the lender's security interest

Tips for Property Buyers and Sellers

If you're buying or selling property:

Research your state's property laws

Keep detailed records of all transactions

Work with qualified real estate professionals

Understand your rights and responsibilities

Need help navigating real estate transactions in your state? Bellhaven Real Estate's experts can guide you through the entire process, making sure you understand your rights and responsibilities as a property owner.