What is a Quadruplex and How Does it Differ from Other Multi-Unit Homes?

I've noticed more real estate investors gravitating toward quadruplex properties lately, and for good reason. These unique multi-unit buildings offer fantastic opportunities for both seasoned investors and first-time buyers looking to start their real estate journey. Let me walk you through everything you need to know about these versatile properties.

Quadruplex: A residential building containing exactly four separate living units, each with its own entrance, kitchen, and bathroom facilities. The units can be arranged side-by-side, stacked vertically, or in a combination of both configurations.

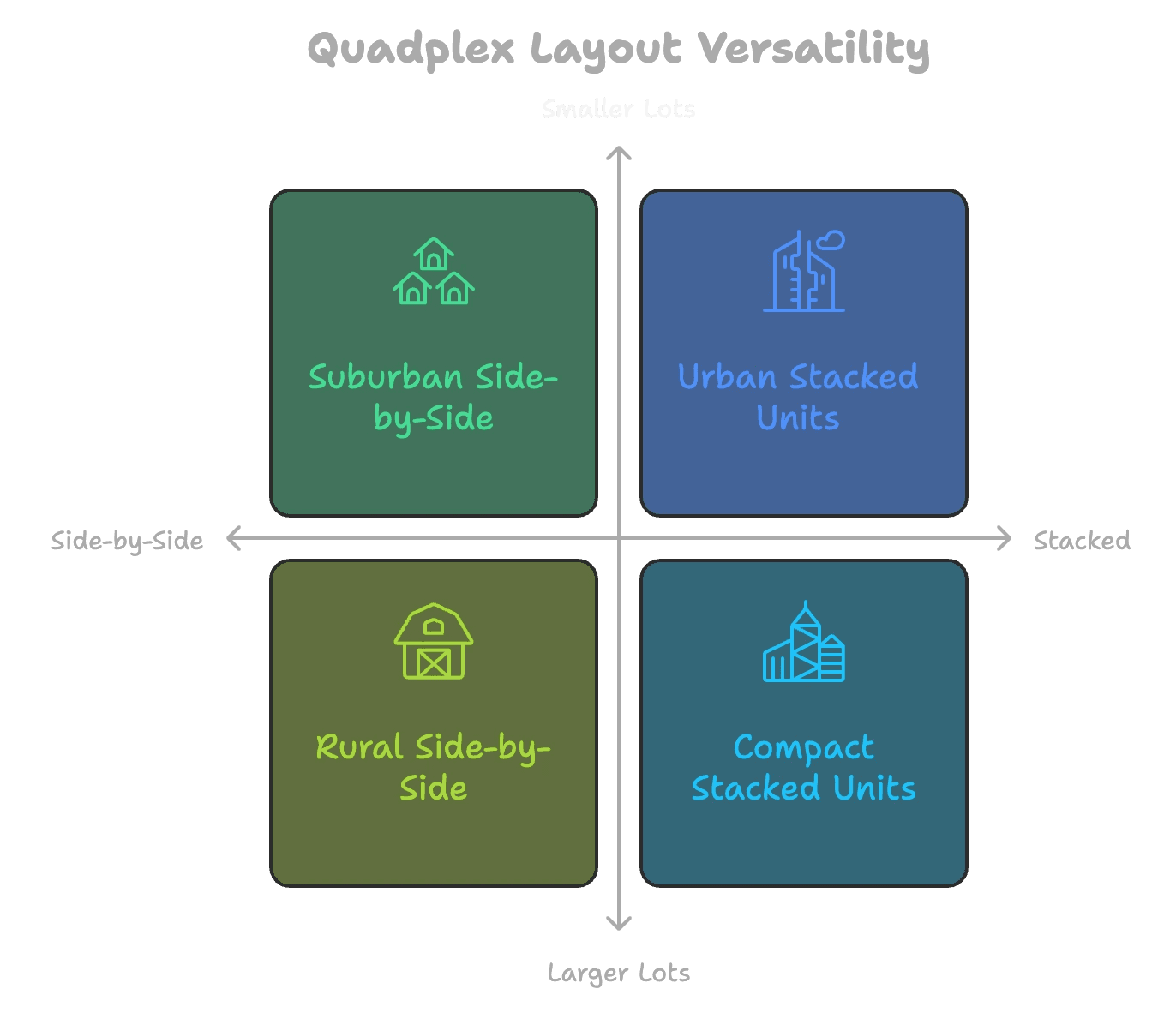

Understanding Quadruplex Configurations

The beauty of quadplex properties lies in their versatile layouts. You might find some with all units lined up side-by-side, perfect for areas with wider lots. Others stack units on top of each other, making the most of smaller city lots. My favorite setup combines both approaches - two units down, two up - creating an efficient use of space while maintaining privacy for tenants.

Typical unit sizes range from 600 to 1,200 square feet, though you'll find variations depending on location and construction era. Victorian-style quads often feature ornate details and larger units, while mid-century builds tend toward practical, streamlined designs.

Benefits of Quadruplex Properties

Four units under one roof create multiple income streams - that's the obvious draw. But here's what makes quads special: you can live in one unit while collecting rent from three others. This strategy (often called "house hacking") helps offset your mortgage and builds equity faster than single-family homes.

Key Advantages:

Four separate income streams

Lower per-unit maintenance costs

Perfect for multi-generational living

Simplified property management

Quadruplex vs. Other Multi-Family Properties

Quads sit in a sweet spot between duplexes and larger apartment buildings. Unlike duplexes, they generate more rental income. Compared to larger multi-family properties, they're easier to finance and manage. Plus, many residential zones permit quadplexes where larger multi-unit buildings aren't allowed.

Financial Aspects

Financing a quad can be surprisingly accessible. In the eyes of financing, they are still considered Residential Real Estate, so they don't follow traditional commercial lending guidelines.

FHA loans allow owner-occupants to purchase with as little as 3.5% down.

Conventional loans typically require 20-25% down for investors.

Operating costs per unit often decrease compared to single-family rentals, thanks to shared walls and systems.

Common Operating Expenses:

Property insurance (typically 20-30% higher than single-family)

Shared utility systems maintenance

Regular exterior upkeep

Property management (if not self-managed)

Legal and Management Considerations

Managing a quad means wearing multiple hats - landlord, maintenance coordinator, and sometimes mediator between tenants. Clear lease agreements, prompt maintenance response, and consistent communication help prevent most common issues.

Common Challenges and Solutions

Vacancy risk? Stagger your lease terms.

Maintenance costs soaring? Set up a preventive maintenance schedule.

Tenant conflicts? Create clear shared space guidelines in your lease.

These simple strategies help smooth out the bumps of quad ownership.

Investment Strategy

Look for properties where market rents support your mortgage payment with room for maintenance reserves. Calculate potential ROI including all expenses:

Basic ROI Formula:

(Annual Rental Income - Annual Expenses) ÷ Total Investment x 100

Consider long-term appreciation potential based on neighborhood trends and local development plans.

Ready to explore quadruplex opportunities? Contact Bellhaven Real Estate today for expert guidance in finding the perfect multi-unit property for your investment goals.