What is a Release of Liability in Real Estate Transactions?

Real estate transactions involve numerous legal documents, but few carry as much weight as a Release of Liability. This powerful legal instrument serves as a shield, protecting parties from future claims and obligations tied to a property. I've noticed many property owners don't fully grasp its significance until they need one.

Release of Liability: A legal document that frees a person or party from responsibility for a debt, claim, or other obligation related to a real estate transaction. This agreement typically involves a lender formally agreeing to no longer hold a borrower personally responsible for repaying a loan or mortgage.

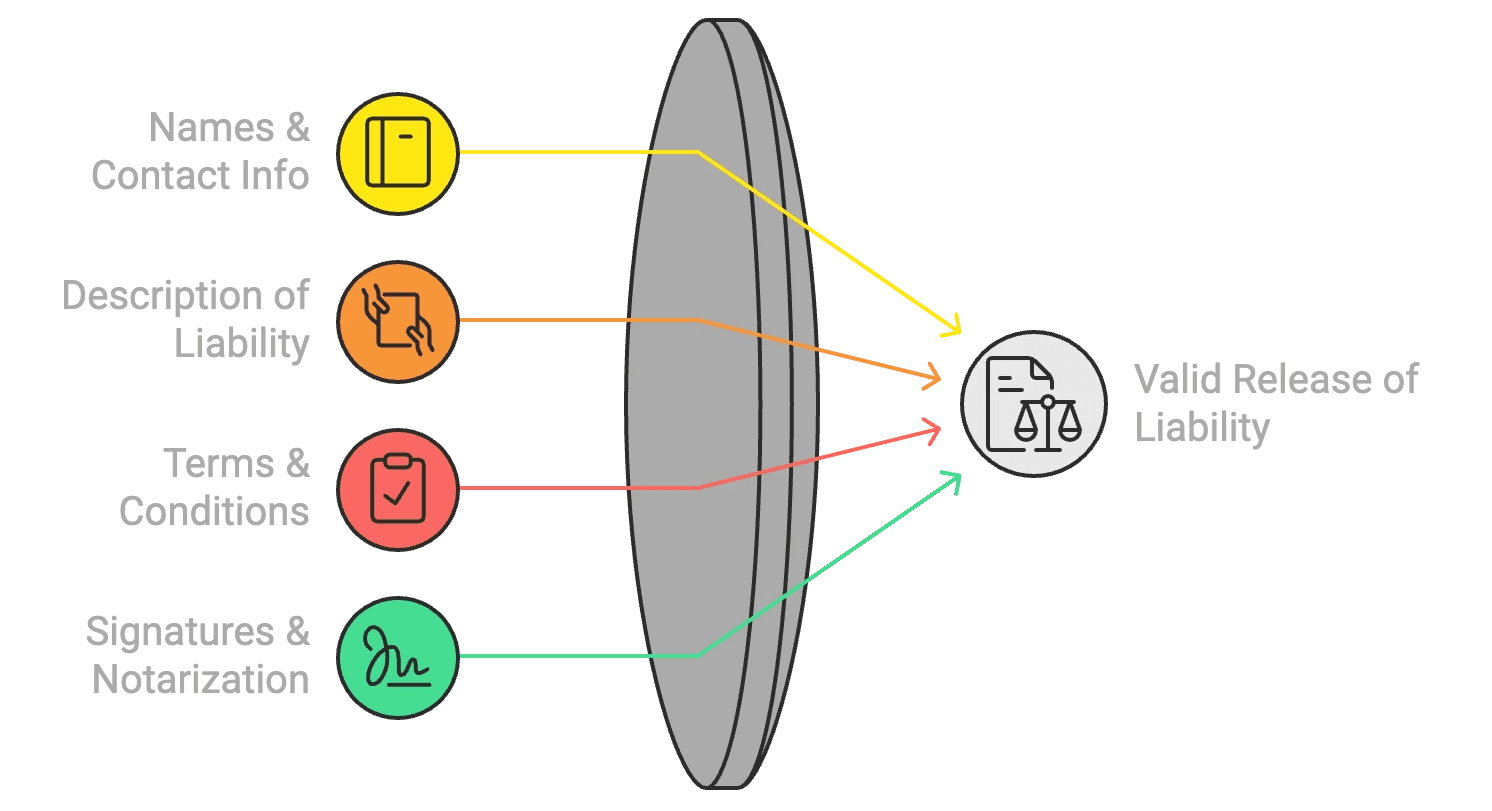

Elements of a Binding Release of Liability

A valid Release of Liability needs several critical elements to hold up legally. The document must clearly identify all parties involved - both those being released and those granting the release. You'll need exact details about the liability being discharged, including dollar amounts, property descriptions, and relevant dates.

Names and contact information of all parties

Clear description of the released liability

Specific terms and conditions

Proper signatures with notarization

Each state has unique requirements for these documents. Some demand witness signatures, while others require specific language about the release terms.

Common Scenarios for Using a Release of Liability

These releases pop up in various real estate situations. During divorces, one spouse might need release from a joint mortgage. Short sales often require releases to protect sellers from deficiency judgments.

Here's where you'll commonly see them:

Property transfers after divorce settlements

Loan modification agreements

Family property transfers

Business partnership splits

Benefits and Risks

Getting a Release of Liability offers clear advantages. You gain protection from future claims and create a clean break from financial obligations. This fresh start lets you move forward without lingering worries about past property dealings.

But watch out for potential issues:

Tax consequences might surface later

Your credit score could take a hit

Future lenders might view your application differently

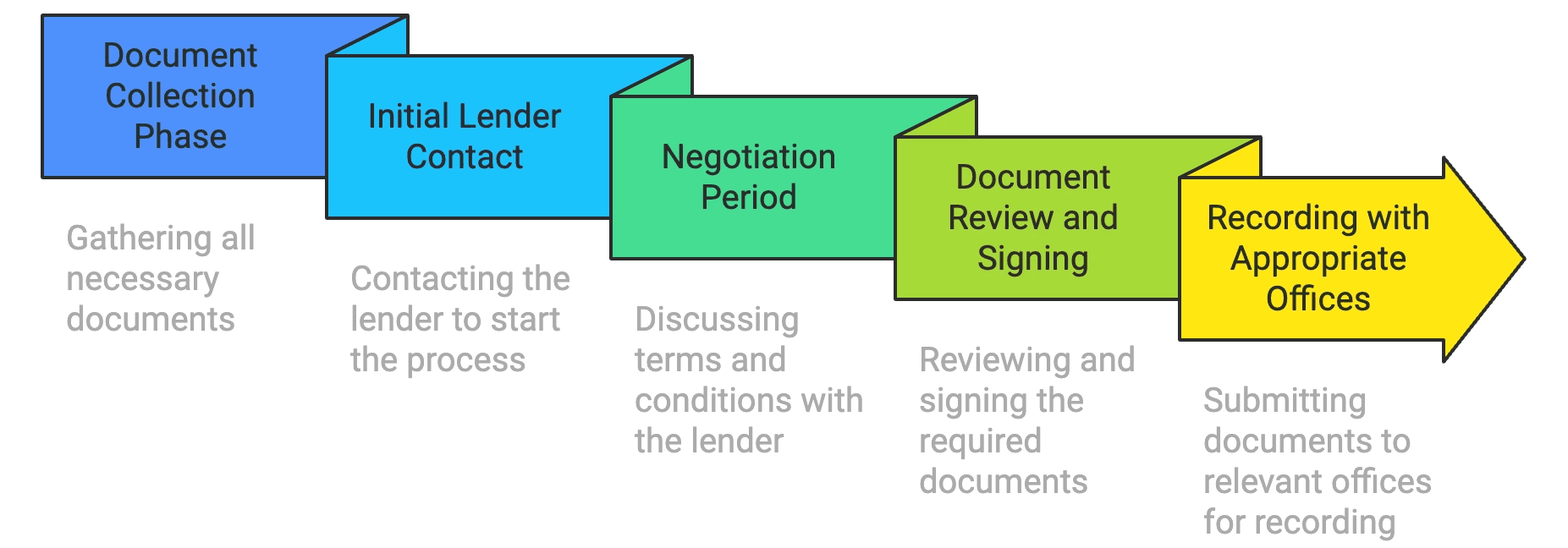

Process of Obtaining a Release of Liability

Starting the release process requires organization. First, gather all relevant documents - loan statements, property records, and financial information. Contact your lender directly to start the conversation. They'll guide you through their specific requirements.

The typical process flows like this:

Document collection phase

Initial lender contact

Negotiation period

Document review and signing

Recording with appropriate offices

Common Misconceptions

People often mix up releases with assumptions of liability. A release ends your responsibility, while an assumption transfers it to someone else. Your credit history might still show the original debt, even after a release. Property rights can get complicated - a release from financial obligation doesn't automatically change ownership rights.

Related Real Estate Concepts

Several legal tools work alongside Releases of Liability:

Quitclaim Deeds: Transfer property rights without warranties

Loan Assumptions: New owner takes over existing loan terms

Indemnification Agreements: Protect against future claims

Mortgage Novation: Complete replacement of original loan agreement

Best Practices and Tips

Work with qualified legal professionals who know local real estate law. Keep copies of everything - every email, document, and conversation note. Expect the process to take several weeks or months. Budget for legal fees and recording costs upfront.

Bellhaven Real Estate brings deep experience with Release of Liability situations. Our team guides property owners through each step, ensuring proper protection of your interests. Ready to discuss your Release of Liability needs? Our real estate professionals stand ready to help you navigate this important legal process.