What is Tenancy by the Entirety in Property Ownership?

Tenancy by the entirety is one of those unique concepts that can really benefit married couples. This form of property ownership offers protection and advantages that other ownership types simply don't match. Let me break down everything you need to know about this powerful ownership structure.

Tenancy by the Entirety: A form of property ownership exclusively available to married couples where both spouses equally own the entire property as a single unit. When one spouse dies, full ownership automatically transfers to the surviving spouse, and neither spouse can sell or transfer their interest without the other's consent.

The Five Unity Requirements

Before you can understand Tenancy by the Entirety, you need to understand the 5 requirements aka the 'Five Unities' to take this form of tenancy. Think of the five unities as building blocks that create this unique ownership structure. Each unity serves a specific purpose and must exist for tenancy by the entirety to work properly.

Unity of Time

Both spouses must receive their ownership rights at the exact same moment. This typically happens when a married couple buys a house together and both names appear on the deed. You can't add a spouse to the title later - you both need to acquire it simultaneously.

Unity of Title

The property title must come from the same source document. This means both spouses get their ownership rights through the same deed, not separate ones.

Unity of Interest

Each spouse owns 100% of the property - not 50/50 like other ownership types. This creates an undivided interest where neither spouse can claim a specific portion of the property.

Unity of Possession

Both spouses have equal rights to use and enjoy the entire property. Neither spouse can exclude the other from any part of the property.

Unity of Marriage

This one's simple - you must be legally married. Without a valid marriage, tenancy by the entirety isn't possible.

Benefits of Tenancy by the Entirety

The benefits of this ownership structure make it particularly attractive for married couples. Here's what makes it special:

Protection from individual creditors

Automatic transfer to surviving spouse

No probate needed for property transfer

Both spouses must agree to sell or transfer

Protection from one spouse's poor financial decisions

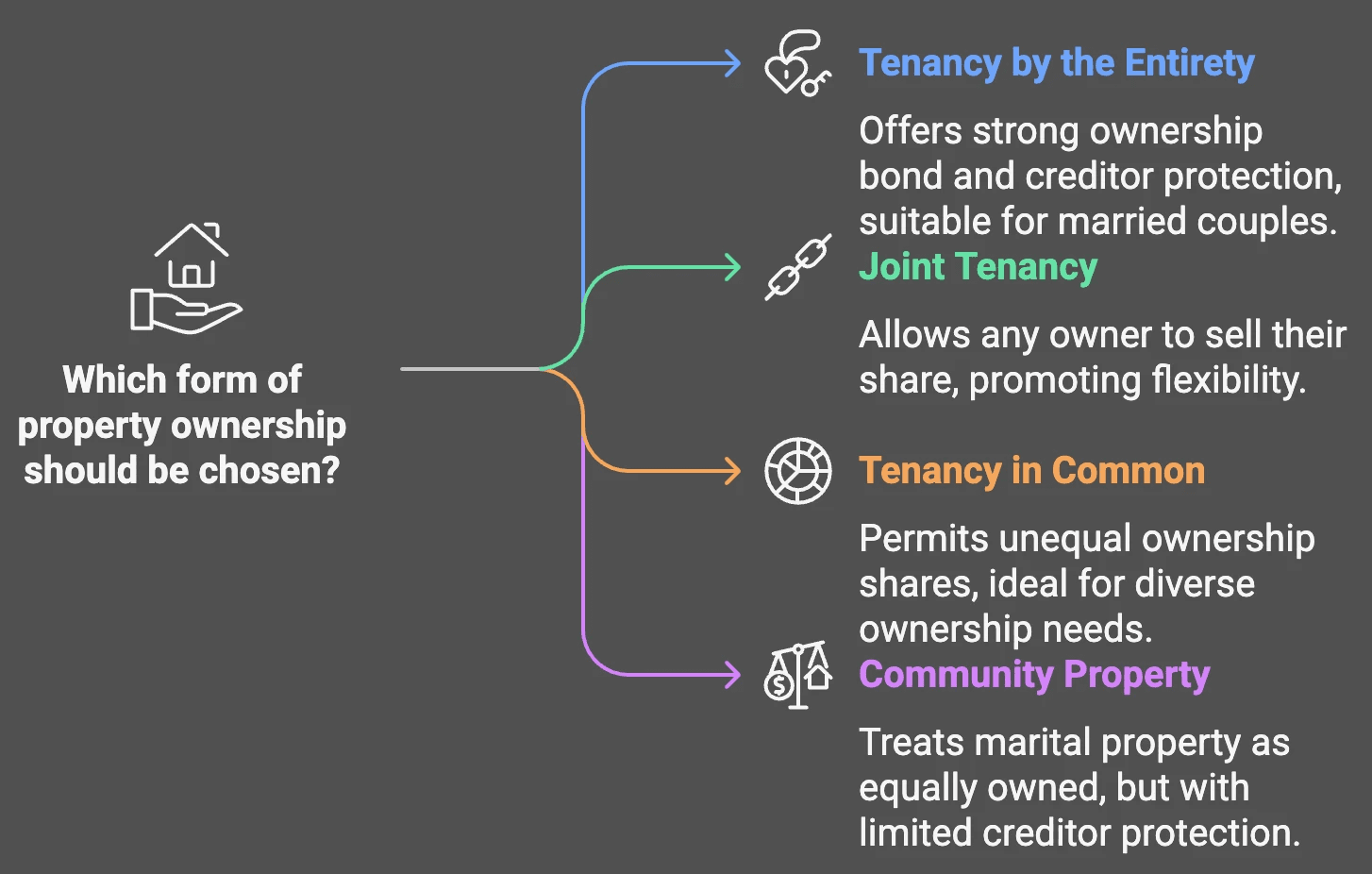

Comparing Ownership Types

Unlike joint tenancy or tenancy in common, tenancy by the entirety creates a stronger bond between owners. Joint tenancy allows any owner to sell their share, while tenancy in common permits unequal ownership shares. Community property treats all marital property as equally owned but doesn't offer the same creditor protection.

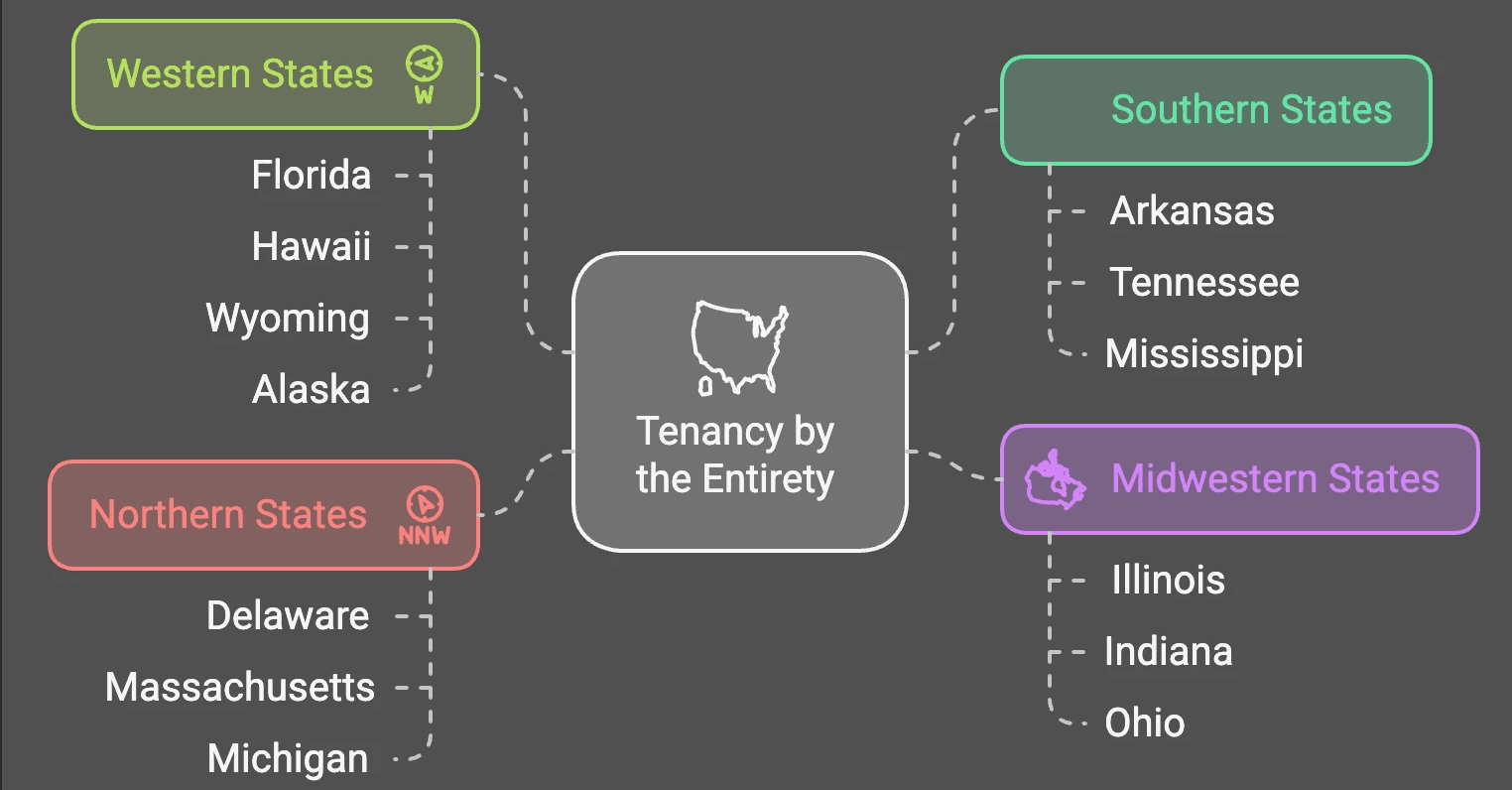

State-Specific Considerations

Not all states recognize tenancy by the entirety. Some states limit it to primary residences, while others allow it for various property types. Check your local laws or speak with a real estate professional to understand your options.

Common Misconceptions

Many people misunderstand how tenancy by the entirety works. Here's the truth:

Divorce converts the ownership to tenancy in common

Federal tax liens can still attach to the property

Both spouses must sign refinancing documents

Practical Applications

This ownership structure works best for:

Primary residences

Vacation homes

Investment properties (where allowed by state law)

Special Circumstances

Bankruptcy, taxes, and estate planning require special attention with tenancy by the entirety. Individual bankruptcy won't affect the other spouse's rights to the property, but joint bankruptcy might. Estate planning becomes simpler since the property automatically transfers to the surviving spouse.

Making the Right Choice

Consider your long-term goals, state laws, and financial situation when choosing this ownership structure. Think about:

Your marriage's stability

Your credit situations

Your estate planning goals

If you're married and buying property, tenancy by the entirety might be perfect for you. Bellhaven Real Estate can guide you through the process and help you make informed decisions about property ownership. Our team understands the nuances of different ownership structures and can help you choose the best option for your situation.