What is a Title Theory State in Real Estate Lending?

I've noticed many homebuyers get confused about property ownership during the mortgage process. Let me clear things up by explaining title theory states - a concept that shapes how property ownership works in several U.S. states.

Title Theory State: A Title Theory State is one where the lender holds legal title to a mortgaged property until the loan is fully paid off, while the borrower maintains the right to use and occupy the property. Under this arrangement, the property title automatically transfers back to the borrower once all mortgage obligations are satisfied.

Use this simple tool to check if your state is Title Theory:

How Title Theory Works

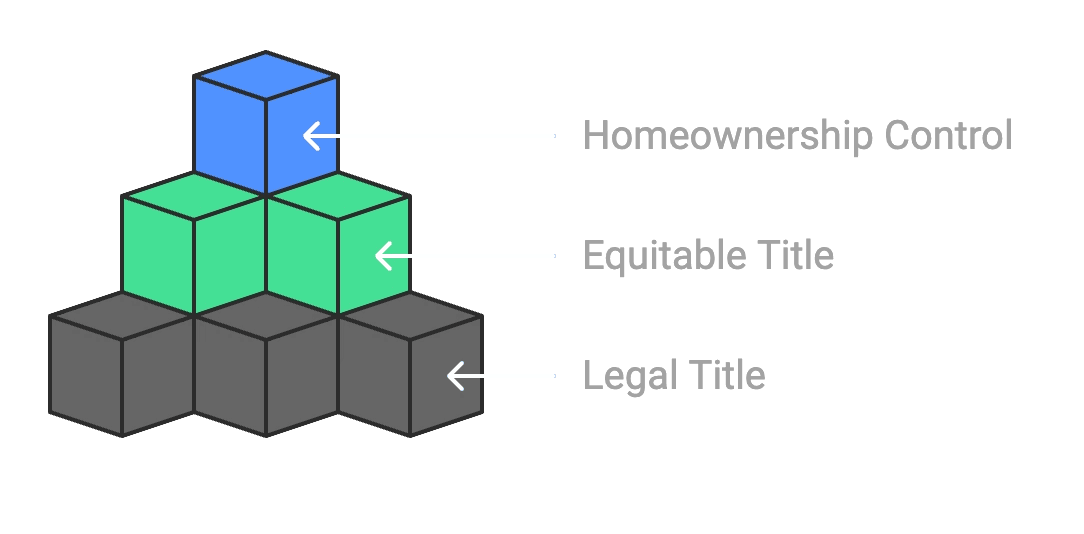

The legal framework of title theory creates a unique ownership structure. While you might think you own your home outright after purchase, in a title theory state, your lender technically holds the legal title until you pay off your mortgage. Don't worry though - you still have what's called "equitable title," which means you can live in the home, make improvements, and use the property as you see fit.

Title companies play a critical role here, managing the paperwork and ensuring proper title transfer both at closing and after loan payoff. They maintain records and help protect everyone's interests throughout the process.

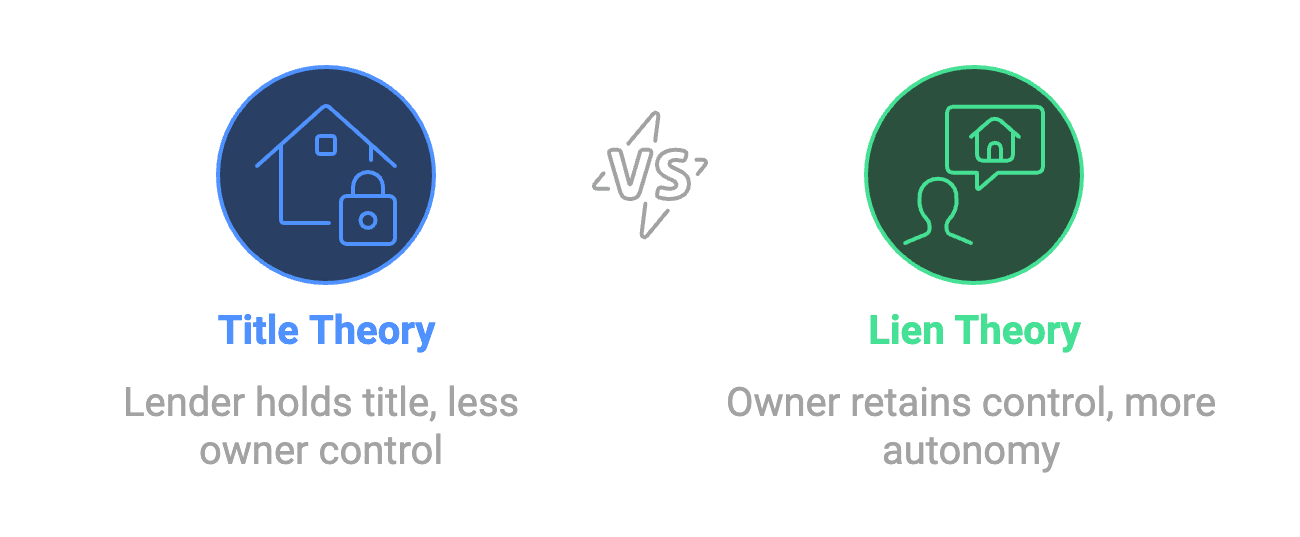

Title Theory vs. Lien Theory States

The main difference between these two approaches lies in who holds the actual property title. In lien theory states, you keep the title, and the lender places a lien on your property. Title theory states give the title to the lender until you pay off the loan.

This distinction affects foreclosure processes too. Title theory states often allow for faster non-judicial foreclosures since the lender already holds the title. However, this doesn't mean you lack protection as a borrower - state laws still provide significant safeguards.

Practical Implications for Property Owners

Buying property in a title theory state requires attention to detail during the mortgage application process. You'll need thorough title searches to verify ownership history and ensure no surprises pop up later.

Your property rights remain strong despite not holding legal title. You can:

Make home improvements

Rent out the property

Sell your interest (with lender approval)

Claim tax benefits

Foreclosure in Title Theory States

If financial troubles hit, title theory states handle foreclosures differently than lien theory states. The process moves more quickly since lenders don't need court approval to start foreclosure proceedings. However, you still have important rights:

Written notice requirements

Time to cure the default

Redemption rights in many cases

Tips for Buyers and Sellers

Many people think not holding legal title means they can't sell their home or make changes to it. This isn't true! Your equitable title rights give you significant control over the property. The main limitation? Major decisions requiring lender approval, like selling or refinancing.

Success in title theory states requires:

Clear understanding of your rights

Proper documentation at every step

Professional guidance through complex transactions

Future of Title Theory

Property records continue moving digital, making title tracking more efficient. Yet the basic principles of title theory remain steady, providing a time-tested framework for real estate lending.

Buying or selling in a title theory state doesn't need to be complicated. Bellhaven Real Estate's experts know the ins and outs of local property laws and can guide you through every step. We'll help you understand your rights and responsibilities while ensuring your transaction goes smoothly. Reach out to us to start your real estate journey with confidence.