What is True Tax in Real Estate Property Assessment?

True Tax serves as your starting point for property tax calculations. Think of it as the "before picture" - what you'd pay without any special discounts or exemptions. This baseline number helps you compare properties fairly and plan your real estate investments more effectively.

True Tax: The total property tax amount calculated for a piece of real estate before any tax exemptions, deductions, or credits are applied. This represents the baseline tax assessment on the property's full value, regardless of any special circumstances or benefits the current owner may qualify for.

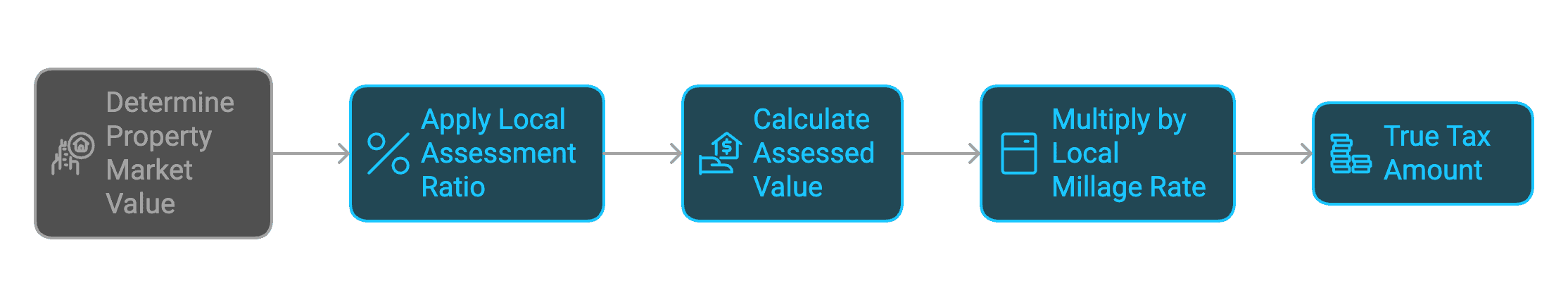

Components of True Tax

Your True Tax calculation starts with property value assessment. Local tax assessors determine your property's market value through:

Physical property inspections

Recent sales data from similar properties

Current market conditions

The assessment ratio then comes into play - this percentage varies by location. For example, if your property's worth $300,000 and your area uses a 60% assessment ratio, your assessed value would be $180,000. This number multiplied by your local millage rate gives you your True Tax amount.

True Tax vs. Actual Tax Bill

Here's where things get interesting! Your actual tax bill often looks quite different from your True Tax amount. Why? Because various exemptions kick in after the True Tax calculation, such as:

Homestead exemptions for primary residences

Senior citizen property tax reductions

Military service member benefits

Farm use exemptions for agricultural properties

True Tax in Real Estate Transactions

During property sales, True Tax information becomes super valuable. Sellers must disclose tax information, and buyers need these numbers to estimate their future expenses. Smart buyers look at both the True Tax and actual tax bills to understand potential changes in their tax burden once ownership transfers.

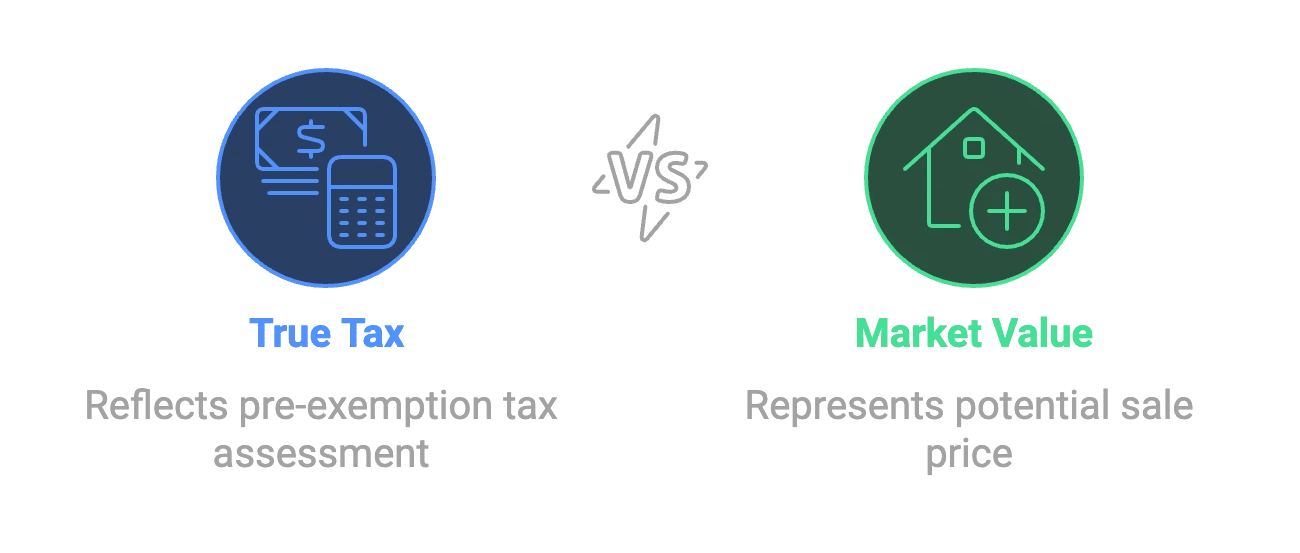

Common Misconceptions About True Tax

I often hear people confuse True Tax with market value - they're not the same thing! True Tax reflects the tax assessment before exemptions, while market value represents what buyers might pay for your property. Another mix-up? Thinking True Tax equals your final tax bill. Remember, exemptions can significantly reduce what you actually pay.

Working with True Tax

Keep these important documents handy:

Annual assessment notices

Tax bills showing both True Tax and final amounts

Records of any exemptions you've claimed

Future Considerations

Property tax systems keep changing. New assessment methods, updated tax rates, and improved technology affect how True Tax gets calculated. Stay informed about local tax policies and assessment practices to protect your interests.

Practical Applications

Review your True Tax assessment yearly. If it seems off, gather evidence like:

Recent sales data from similar properties

Photos showing property condition issues

Professional appraisals

Making Informed Real Estate Decisions

True Tax knowledge helps you make smarter property decisions. Partner with Bellhaven Real Estate for expert guidance on property tax matters. Our team can help review and understand your tax assessments.