What is a Double Escrow in Real Estate Transactions?

I've noticed many real estate investors get confused about double escrows, but they're actually quite straightforward once you understand the basics. Let me break it down for you.

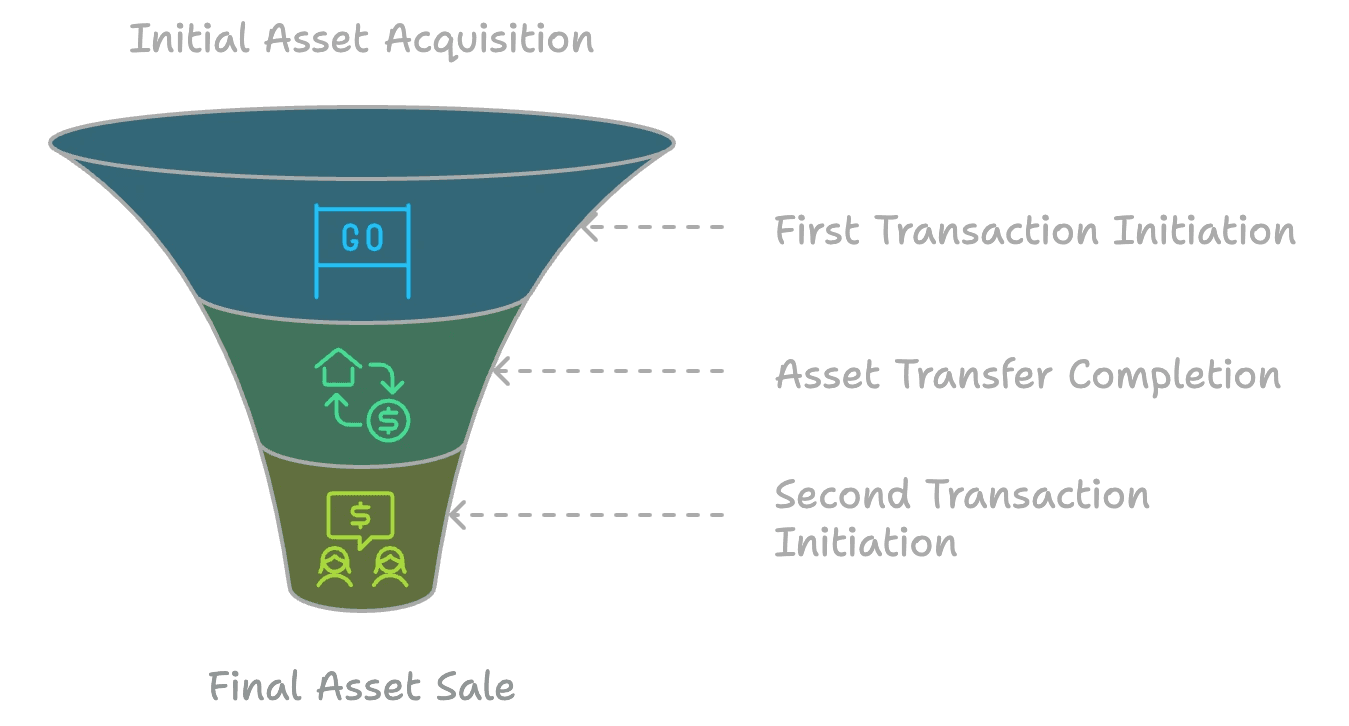

Double Escrow: A real estate transaction where the closing of one property sale depends on the successful completion of another related property sale. The two transactions are linked together, with the second sale unable to proceed until the first one closes.

Introduction to Double Escrow in Real Estate

Double escrows pop up frequently in investment scenarios, particularly when someone spots an opportunity to buy low and sell high within a short timeframe. Think of it like a relay race - the first runner (transaction) needs to pass the baton before the second runner (transaction) can start their leg of the race.

These transactions exist primarily because they allow investors to purchase properties without using their own funds. They're particularly common in wholesale deals and property flips where timing is critical.

The Mechanics of a Double Escrow

The process starts with the original property owner agreeing to sell their property. An intermediary buyer (often an investor) contracts to purchase this property. Before that sale closes, the intermediary buyer finds an end buyer willing to purchase the property at a higher price.

The key players include:

Original property owner (first seller)

Intermediary buyer/seller (usually an investor)

End buyer

Two escrow companies (sometimes the same company handles both)

Title companies

Legal and Ethical Considerations

I'd like to stress that double escrows are legal, but they require proper disclosure. Each state has different rules about how these transactions should be handled. For example, some states require written notice to all parties about the double escrow arrangement.

Red flags to watch for:

Lack of transparency about the transaction structure

Pressure to skip important documentation

Requests to hide information from lenders

Benefits and Risks

Double escrows offer several advantages:

Minimal upfront capital requirements

Quick profit potential

Opportunity to create value through market knowledge

But they also come with challenges:

Complex coordination between multiple parties

Strict timing requirements

Potential for deals to fall through if one transaction fails

Common Applications

I see double escrows most often in:

Wholesale deals where investors find discounted properties

Fix-and-flip scenarios requiring quick turnaround

Investment property acquisitions with immediate resale plans

Tips for Successful Double Escrow Transactions

Success in double escrows requires:

Clear paper trails for all agreements

Open communication between all parties

Realistic timelines for both transactions

Professional support from experienced title companies

Frequently Asked Questions

Q: Is double escrow legal?

A: Yes, with proper disclosure and compliance with state regulations.

Q: Who pays the closing costs?

A: This varies by agreement, but typically each transaction has its own closing costs.

Q: Can you use double escrow with bank-owned properties?

A: Yes, but banks might have specific requirements or restrictions.

Q: How long does the process take?

A: Usually both transactions close on the same day or within a few days of each other.

Alternative Methods

You might consider these options instead of a double escrow:

Assignment of contract - transferring your purchase rights to another buyer

Traditional back-to-back closings - completing one sale before starting another

Working with Professionals

Success in double escrows often depends on working with experienced professionals. Look for:

Title companies familiar with simultaneous closings

Real estate agents who understand investment transactions

Attorneys who specialize in real estate law

Bellhaven Real Estate's team of experienced professionals can guide you through these complex transactions. Our network includes trusted title companies and attorneys who specialize in investment deals.