What is an Escrow Officer's Role in Real Estate Transactions?

I've noticed many homebuyers feel overwhelmed by the real estate process, particularly when it comes to understanding who handles their money during a property purchase. That's where escrow officers step in - they're the neutral third party who keeps everything running smoothly and securely during your real estate transaction.

Escrow Officer: A licensed professional who manages the escrow process during a real estate transaction by holding funds and documents in trust until all conditions of the sale are met. The escrow officer ensures that all terms of the purchase agreement are fulfilled and coordinates the transfer of property ownership between buyers and sellers.

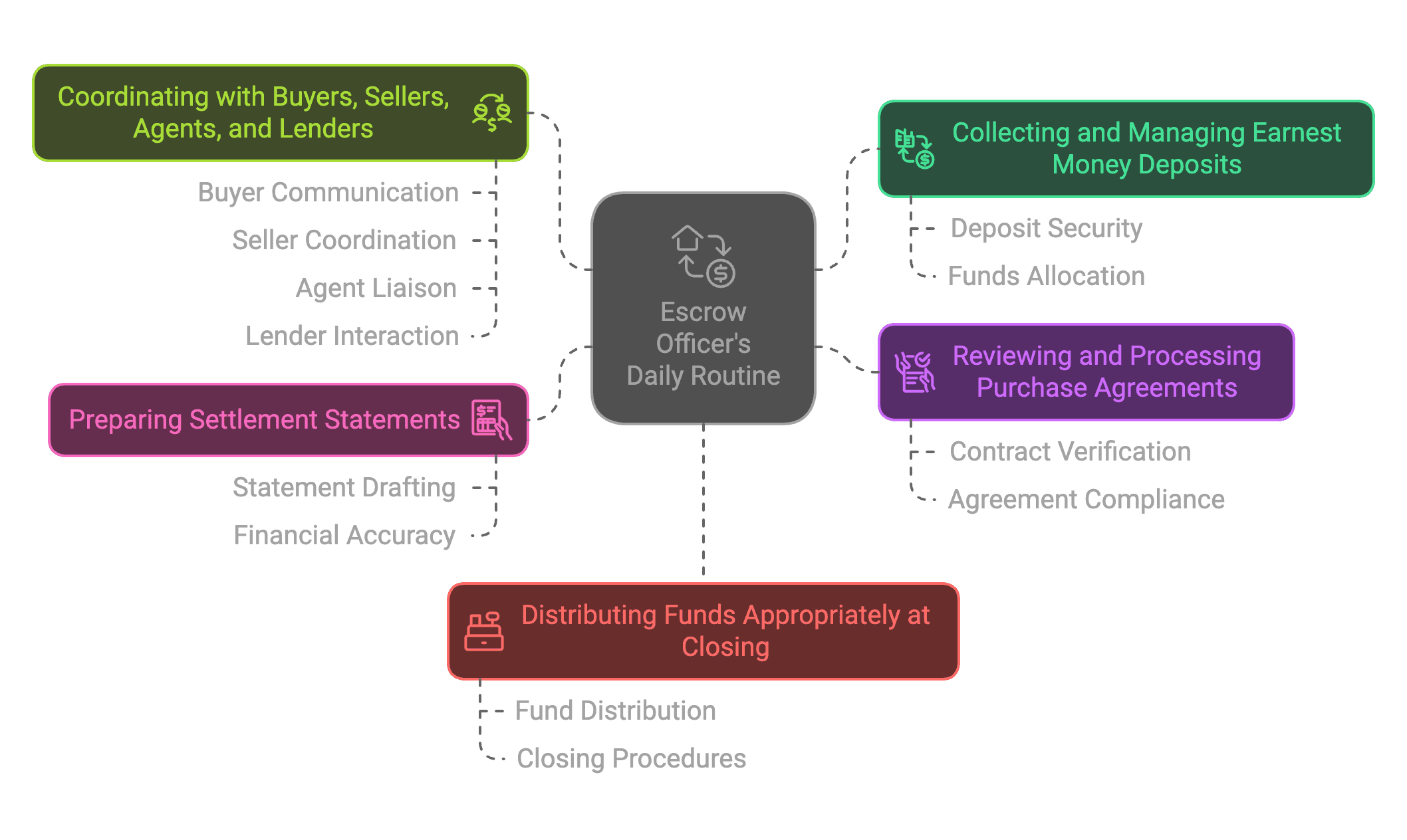

The Day-to-Day Life of an Escrow Officer

An escrow officer's daily routine involves much more than just holding onto money. They spend their time reviewing documents, coordinating with multiple parties, and making sure every detail of your transaction follows state regulations.

Their primary responsibilities include:

Collecting and managing earnest money deposits

Reviewing and processing purchase agreements

Coordinating with buyers, sellers, agents, and lenders

Preparing settlement statements

Distributing funds appropriately at closing

To become an escrow officer, you need specific qualifications:

State licensing - Requirements vary by location

Professional certifications - Such as Certified Escrow Officer (CEO)

Technical knowledge - Real estate law, title insurance, and financial procedures

The Escrow Process Step-by-Step

Let me walk you through how the escrow process typically flows:

Opening Escrow: Once you have an accepted offer, your agent opens an escrow account.

Document Collection: The escrow officer gathers necessary paperwork from all parties.

Fund Management: They collect and hold your earnest money and other required funds.

Closing Procedures: All parties sign final documents and verify terms are met.

Final Disbursement: Money gets distributed to appropriate parties.

Working with Other Real Estate Professionals

Escrow officers don't work in isolation. They're part of a network of professionals making your real estate transaction happen. They coordinate with:

Real estate agents to track contingencies and deadlines

Title companies to clear property titles

Lenders to receive and process loan documents

Attorneys to handle legal aspects of the transaction

Common Misconceptions and FAQs

Let's clear up some confusion about escrow officers:

Myth: "Escrow officers and title officers are the same thing"

Reality: While they often work together, these are separate roles with different responsibilities

Myth: "The escrow officer works for the seller"

Reality: They're neutral third parties working for both buyer and seller

Myth: "Escrow services are optional"

Reality: Most states require escrow services for real estate transactions

Choosing the Right Escrow Officer

Look for these qualities in your escrow officer:

Clear communication style

Organized and detail-oriented

Responsive to questions

Strong reputation in your area

Red flags to watch for:

Poor communication

Missed deadlines

Unclear fee structures

Negative reviews or complaints

Finding a trustworthy escrow officer makes a big difference in your real estate transaction. At Bellhaven Real Estate, we maintain relationships with reliable escrow professionals who prioritize your interests. Contact us for a free consultation - we'll connect you with an escrow officer who matches your needs and helps make your property purchase or sale smooth and secure.