What is a Mortgage Constant and How Does it Affect Loan Payments?

If you've ever wondered how to quickly figure out your annual loan payments as a percentage of your original loan amount, you're about to discover one of the handiest calculations in the business.

Mortgage Constant: A fixed percentage used to calculate the annual payment needed to cover both interest and principal on a loan, typically expressed as a percentage of the original loan amount. This percentage helps determine the monthly mortgage payment that will fully repay the loan over its term.

Heres a simple Mortgage Constant Calculator:

Understanding How Mortgage Constants Work

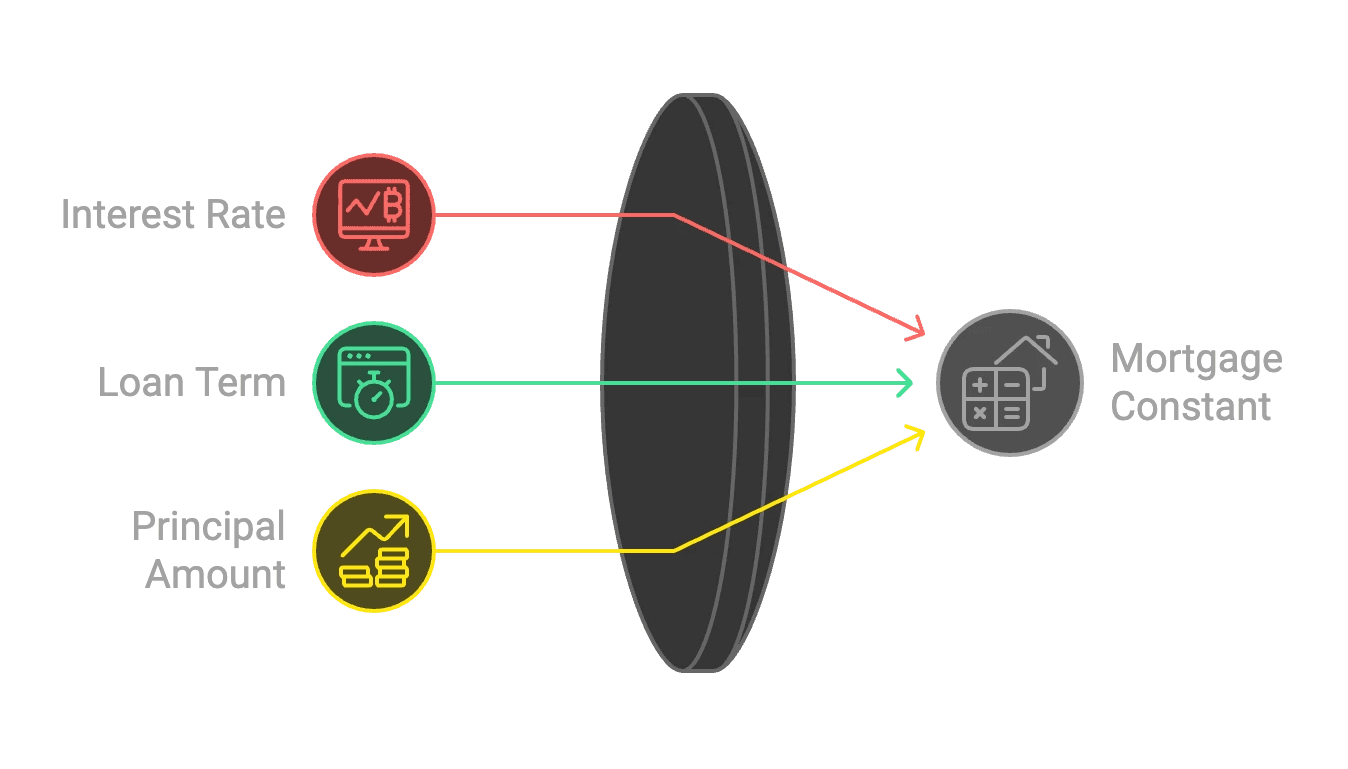

The mortgage constant isn't complicated once you break it down. Think of it as a recipe with three main ingredients: the interest rate, loan term, and principal amount. These components work together to create a single percentage that tells you exactly what portion of your loan amount you'll pay annually.

For example, if you have a $300,000 loan with a mortgage constant of 6%, your annual payment would be $18,000 ($300,000 x 0.06). Divide that by 12, and you've got your monthly payment of $1,500. Simple, right?

Practical Applications

I see mortgage constants used most often in commercial real estate, where investors need to compare different properties and loan options quickly. But they're just as useful for residential properties too.

Commercial Real Estate Uses:

Comparing different financing options side by side

Calculating potential cash flow from rental properties

Making quick investment decisions

Residential Real Estate Uses:

Planning monthly budgets

Understanding total payment obligations

Comparing different loan terms

Benefits and Limitations

The beauty of mortgage constants lies in their simplicity. They make it super easy to compare different loans and understand your payment obligations upfront. However, they do have their limits.

Benefits:

Makes loan comparisons straightforward

Helps with quick calculations

Perfect for initial property analysis

Limitations:

Only applies to fixed-rate loans

Doesn't account for taxes or insurance

May not reflect actual costs in adjustable-rate scenarios

Common Misconceptions

People often mix up mortgage constants with interest rates. While they're related, they're not the same thing. The interest rate is just one part of your payment, while the mortgage constant includes both principal and interest payments.

Related Concepts

Understanding mortgage constants becomes even more valuable when you connect it with other real estate metrics:

Debt Service Coverage Ratio (DSCR) - Shows if property income can cover loan payments

Capitalization Rate - Helps evaluate property value based on income

Loan-to-Value Ratio - Determines risk by accounting for % down.

Real-World Applications

Let's say you're looking at a commercial property listed at $1,000,000. With a mortgage constant of 7.5%, you'd know immediately that your annual debt service would be $75,000. This quick calculation helps you determine if the property's income can support the loan payments.

Final Thoughts

Mortgage constants are a valuable tool in real estate finance, making it easier to understand and compare loan payments. Whether you're investing in commercial property or buying your first home, knowing how to use mortgage constants can help you make better financial decisions.

Ready to put this knowledge to work? Bellhaven Real Estate's experts can help you analyze potential properties and find the right financing options for your needs. Schedule a consultation to discuss your real estate goals and get personalized guidance on your next property purchase.