What is a Voluntary Lien When Buying a House?

Buying a house often involves more than just finding your dream home and making an offer. Most of us need financing to make it happen, which brings us to an important aspect of real estate: voluntary liens. If you've ever signed mortgage papers, you've already dealt with one!

Voluntary Lien: A legal claim placed on a property with the owner's knowledge and consent. Common examples include mortgages, home equity loans, and other financing arrangements where the property owner willingly agrees to use their property as collateral.

The Basics of Voluntary Liens

Think of a voluntary lien as a handshake agreement between you and a lender - except this handshake comes with legal paperwork! Three main elements make up these liens:

Your explicit consent as the property owner

Legal documentation that spells out all terms

Your property serving as collateral

The most common types of voluntary liens you'll encounter include:

Mortgages: The primary lien most homeowners have

Home Equity Loans: Second mortgages that tap into your home's value

Construction Loans: Short-term financing for building or renovating

HELOC: A revolving credit line secured by your home

How Voluntary Liens Work

Getting a voluntary lien isn't complicated, but it does require careful attention to detail. First, you'll submit an application to your chosen lender. They'll review your credit history, income, and other financial factors.

The paperwork phase comes next. You'll sign numerous documents that outline the terms of your agreement. These documents then go to your county recorder's office, making the lien public record.

An important detail: liens follow a priority order. Your first mortgage typically takes precedence over later liens, which matters if financial troubles arise.

Benefits and Risks

Voluntary liens offer several advantages:

Access to larger amounts of money than unsecured loans

Better interest rates than credit cards or personal loans

Potential tax deductions on mortgage interest

But they come with risks too:

Your home could face foreclosure if you default

Selling becomes more complex with liens attached

Your credit score could take a hit if payments slip

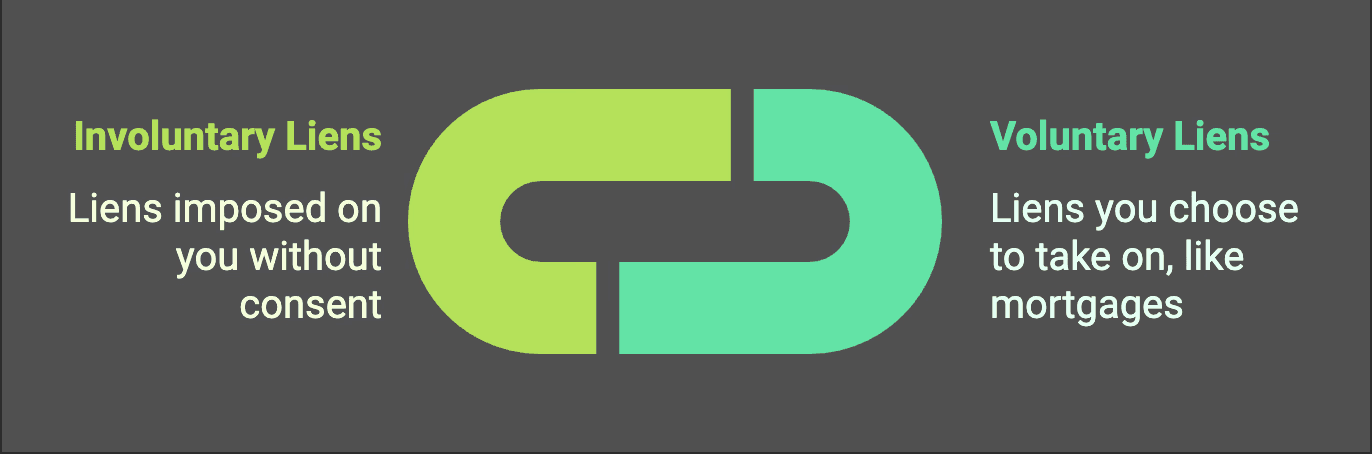

Voluntary vs. Involuntary Liens

Unlike voluntary liens, involuntary liens pop up without your consent. Tax liens, judgment liens, and mechanic's liens fall into this category. They're usually harder to resolve and can cause more headaches than voluntary liens.

Common Misconceptions & How to Manage them

Let's clear up some confusion about voluntary liens:

Not all liens spell trouble - voluntary liens help millions buy homes

You can remove voluntary liens by paying off the loan

Yes, you can have multiple liens on your property (though it might not be wise)

Success with voluntary liens requires attention and strategy:

Check your lien status yearly

Make payments on time, every time

Consider refinancing if rates drop significantly

Get written confirmation when you pay off a lien

Impact on Real Estate Transactions

Buying or selling property with liens requires extra steps. A thorough title search reveals all liens on a property. For sellers, all liens typically need clearing before or at closing. Buyers should know exactly which liens exist before making an offer.

Bellhaven Real Estate agents understand the complexities of property liens and can guide you through your next transaction. Contact us for a consultation and take the first step toward your new home today!