What is a Yield Spread Premium in Mortgage Lending?

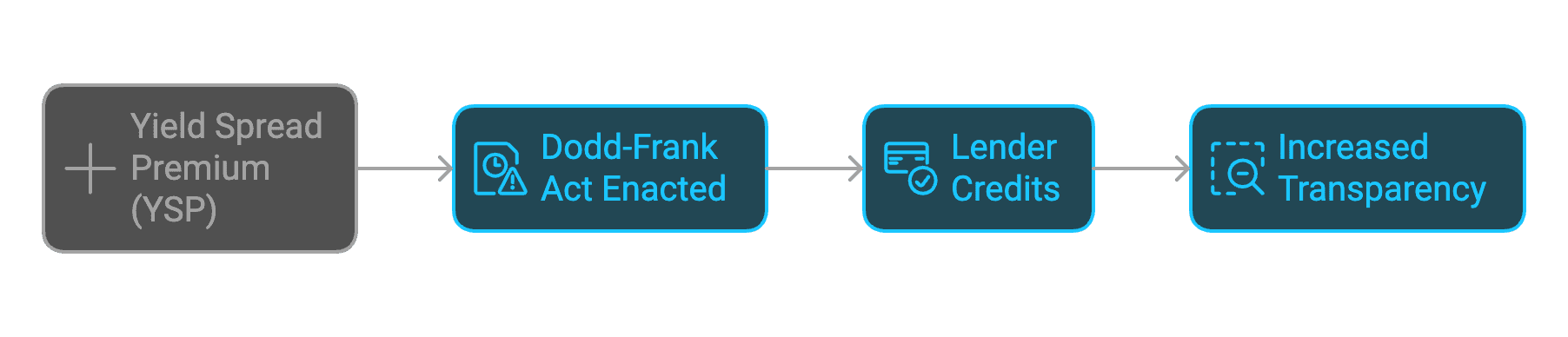

You might hear old-school mortgage folks talk about YSP (Yield Spread Premium), but here's the thing - it's not actually used anymore. Back in 2011 the Dodd-Frank Act changed these rules around. These days, we use something called "lender credits" instead, which is basically a more transparent way of doing the same thing.

Yield Spread Premium (YSP): A fee paid by a lender to a mortgage broker for arranging a loan with a higher interest rate than the minimum rate the borrower qualified for. The yield spread premium allows borrowers to reduce their upfront closing costs in exchange for paying a higher interest rate over the life of the loan.

Out With the Old, In With the New

So what was YSP? It was pretty interesting, actually. It was the money that mortgage investors would pay to brokers when they wrote loans at above-market interest rates. Think of it this way: if you qualified for a 6% rate but took a 6.5% loan instead, the investor would pay the broker extra money because they'd make more over time from that higher rate.

This created a bit of a three-way dance:

Investors got loans that would make them more money

Brokers could earn extra commission

Borrowers could trade a higher rate for lower closing costs

How YSP Created a Three-Way Street

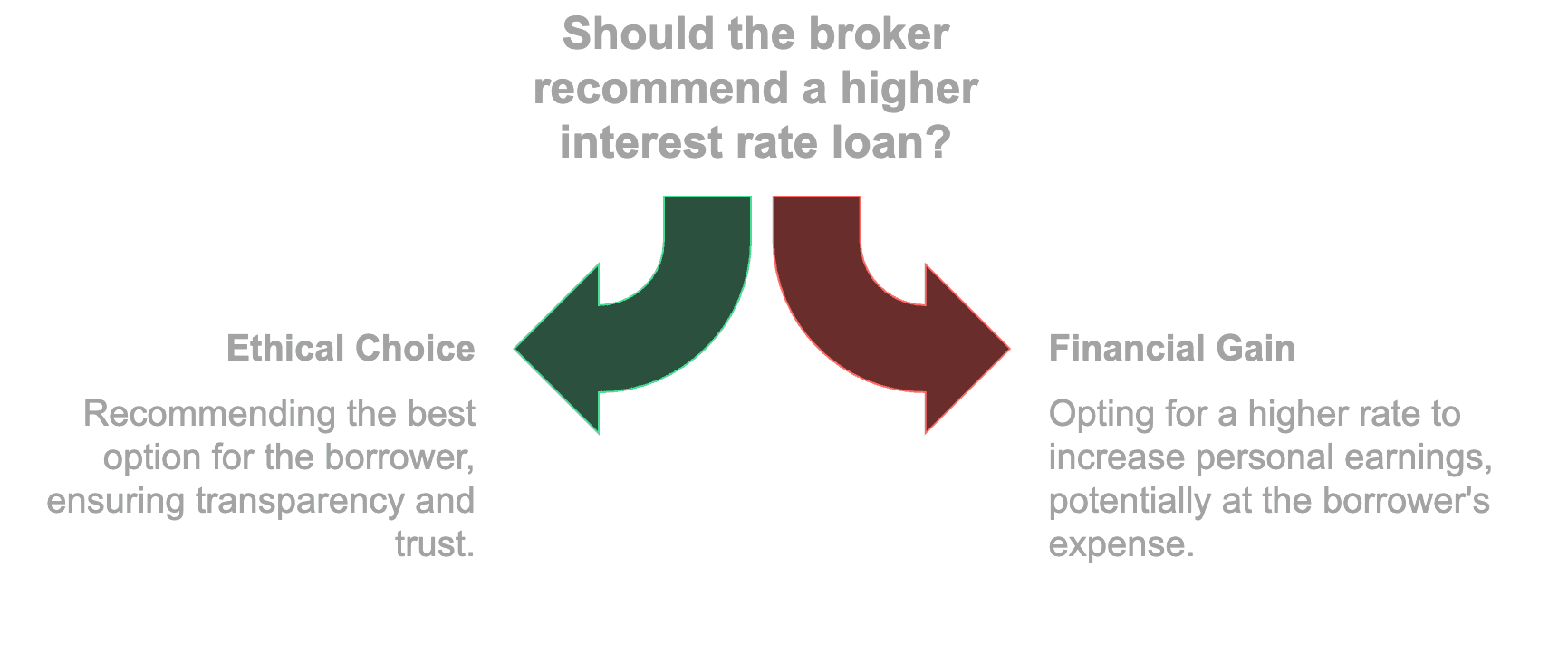

But there was a problem. Some brokers weren't being totally upfront about how much they were making from these higher rates. Sometimes they'd push borrowers toward a higher rate because it meant more money in their pocket, not because it was the best choice for the borrower. The system was broken, it forced a tough choice for mortgage brokers to make… many made the wrong one.

Why YSP Had to Go

That's why things changed. Today's system of lender credits is much simpler: if you take a higher rate, any extra money has to go directly toward reducing your closing costs. Your loan officer gets paid the same regardless of which rate you choose. Everything gets disclosed clearly on your loan estimate - no surprises.

The cool thing is you can still make that trade-off between rates and closing costs. You just get to do it with all the cards on the table. Want a lower rate? You'll pay more upfront. Need help with closing costs? You can take a slightly higher rate and get a lender credit. Simple as that.

Finding Your Best Option

At Bellhaven Real Estate, we can help you figure out which option makes the most sense for your situation. Sometimes paying more upfront for a lower rate is smart - especially if you'll keep the loan for a long time. Other times, taking a lender credit and a slightly higher rate might be the way to go.

The key is understanding your options and making an informed choice. That's what we're here for - to help you navigate these decisions without all the confusing industry jargon.